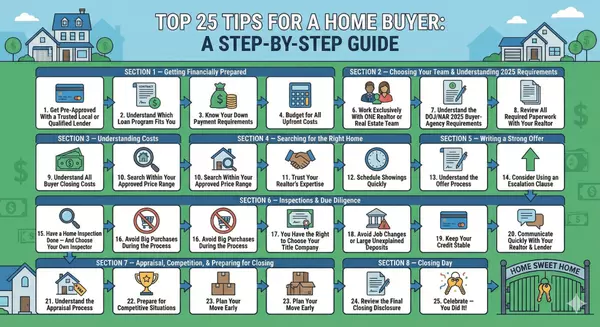

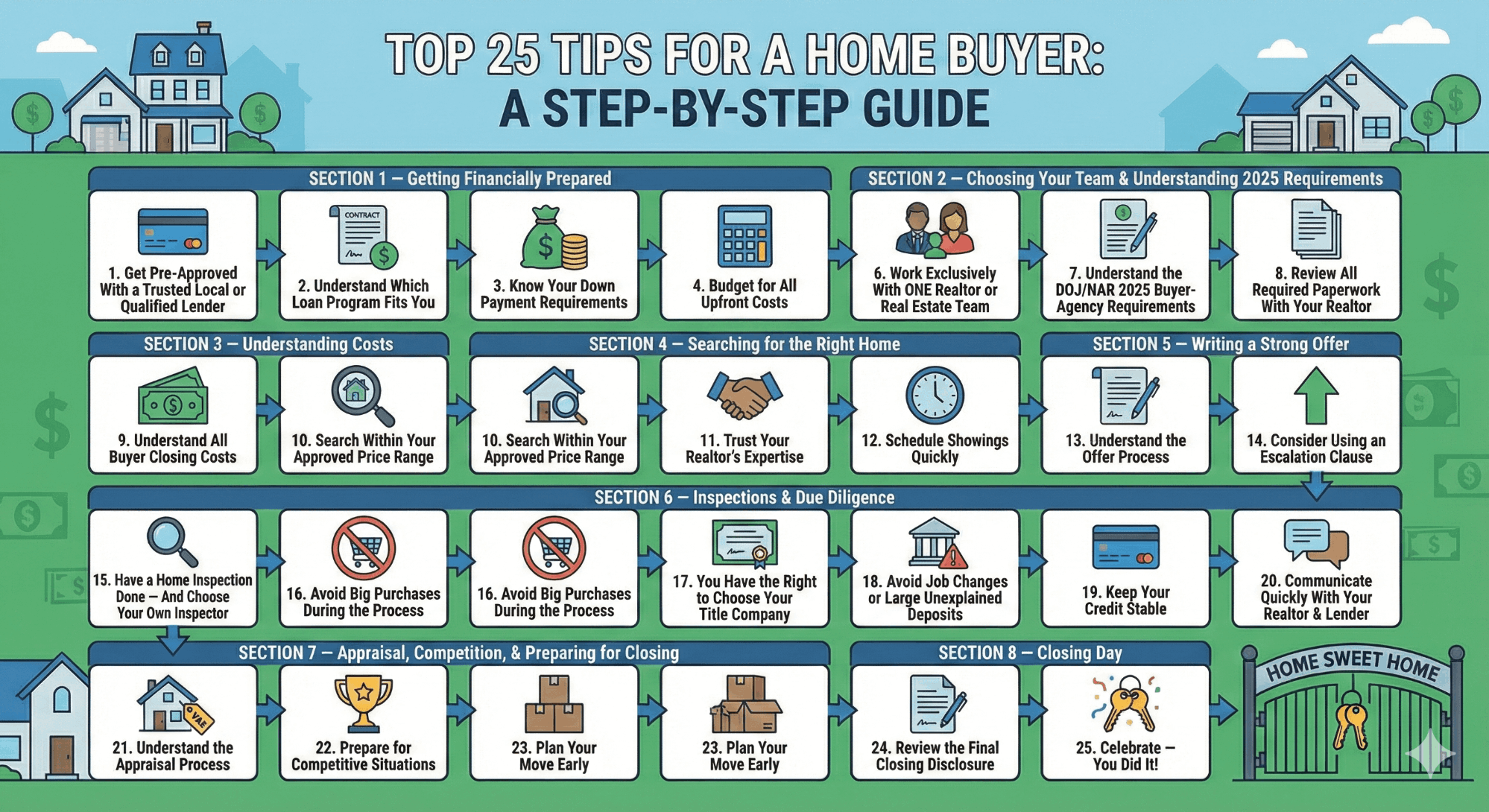

The Ultimate Homebuyer Guide: 25 Essential Steps to Successfully Purchase a Home

The Ultimate Homebuyer Guide: 25 Essential Steps to Successfully Purchase a Home

SECTION 1 — Getting Financially Prepared

1. Get Pre-Approved With a Trusted Local or Qualified Lender

A pre-approval shows sellers you are serious, helps define your price range, and strengthens your offer. Local lenders understand Northern Minnesota timelines and expectations.

2. Understand Which Loan Program Fits You

Conventional, FHA, VA, USDA/RD — each comes with different down payment requirements, mortgage insurance, and benefits. Your lender and Realtor will help you choose the best option. We need to know which loan to also make sure that the house will fit for the loan, or the loan to fit the house. For example, a USDA / RD loan is great, but seldom works for a house that is a fixer upper.

3. Know Your Down Payment Requirements

Many buyers use 0–5% down programs. Some require 5%, 10% or 20%. There are certainly different loans to fit different situations and having the buyer, the agent and lender all on the same page will help you achieve your goals. Your down payment impacts your monthly payment, loan terms, and overall offer strength.

4. Budget for All Upfront Costs

Beyond the down payment, plan for closing costs, appraisal, inspection fees, earnest money, and moving expenses so nothing catches you off guard. Most of these costs will be from the lending side and from the closing company.

5. Learn How Earnest Money Works

Earnest money is a good-faith deposit that shows your commitment. A larger deposit often makes your offer more competitive. It applies toward your closing costs — not an extra fee. Example, one seller receives 2 different offers on their house. Both at $300,000 and both conventional financing. One offer offers $1,000 earnest money and the second offer offers $5,000 earnest money. Same offer price but to the seller, one offer already looks much better and the buyer appears to be in a better position.

SECTION 2 — Choosing Your Team & Understanding 2025 Requirements

6. Work Exclusively With ONE Realtor or Real Estate Team

This ensures loyalty, fast communication, market expertise, and consistent strategy from start to finish. Not only is this a part of a Buyer Rep Agreement, picking an agent to work with will be able to do a better job the more we get to know each other and fine tune what you are actually looking for. Signing multiple contracts to work with more than one agent could also result in fees that a buyer does not want to incur.

7. Understand the DOJ/NAR 2025 Buyer-Agency Requirements

Starting August 2024, buyers must sign a Buyer Representation Agreement or a Showing Document before viewing homes.

This agreement explains:

- How your agent is compensated

- Whether the seller may contribute or pay for this

- When the buyer may be responsible

- What duties your agent owes you

This transparency protects buyers and improves communication.

8. Review All Required Paperwork With Your Realtor

Your agent will explain:

- Buyer Representation Agreement

- Agency Disclosure

- Purchase Agreement

- Arbitration Disclosure

- Seller Property Disclosures

- Lead-based paint disclosures

- Loan-specific forms (FHA, RD, VA, etc.)

Understanding these early reduces stress later.

SECTION 3 — Understanding Costs

9. Understand All Buyer Closing Costs

Cash Buyers May Pay:

- Title insurance

- Title search/title exam (especially for land)

- Title company closing fee

- County recording fee for your new deed

- Home inspection fee

Financed Buyers Also Pay:

- Appraisal fee

- Lender origination/underwriting fees

- Credit report fees

- Mortgage registration or state-specific taxes

- Discount points or mortgage insurance (if applicable)

Your lender will provide a Loan Estimate so you know these costs upfront.

SECTION 4 — Searching for the Right Home

10. Search Within Your Approved Price Range

Staying within your budget prevents disappointment and ensures you’re prepared to write a strong offer. Typically a more expensive property will have more features, possibly more square footage and possibly nicer products. However, if its not in your price range or budget, it will look better but is a disappointment if you really are not able to afford it.

11. Trust Your Realtor’s Expertise

Lean on your Realtor’s experience with pricing, competition, red flags, neighborhoods, and negotiations. If you feel your realtor is just trying to "sell you a house", they may not be the best fit for you.

12. Schedule Showings Quickly

Homes can sell fast, especially in Bemidji and surrounding communities. Seeing homes early increases your chances of success.

SECTION 5 — Writing a Strong Offer

13. Understand the Offer Process

Your Realtor will help you structure:

- Price

- Earnest money

- Closing date

- Financing terms

- Inspection contingencies

- Other protections and conditions

A clean, well-written offer often beats a higher offer with weaker terms.

14. Consider Using an Escalation Clause

In multiple-offer situations, an escalation clause can automatically increase your offer above competing bids (up to a limit you select).

Your Realtor will guide you on when this strategy makes sense.

SECTION 6 — Inspections & Due Diligence

15. Have a Home Inspection Done — And Choose Your Own Inspector

A professional inspection protects your investment. Inspectors evaluate roofs, structure, mechanicals, electrical, plumbing, and more.

You choose your inspector — your Realtor can recommend trusted local professionals. There are several good options in our area for this.

16. Avoid Big Purchases During the Process

Do not finance cars, boats, appliances, or furniture, and avoid “no-interest” deals. These can change your debt-to-income ratio and jeopardize your loan. Close on your new house first, there will be plenty of time and sales to get that new couch or dining room table.

17. You Have the Right to Choose Your Title Company

Just like picking your lender, you can select any reputable title company to close your transaction.

A great title company ensures accurate documents, smooth communication, and a stress-free closing.

We have several title companies that can close a transaction remotely to make things as smooth as possible.

18. Avoid Job Changes or Large Unexplained Deposits

Lenders verify employment and financial stability. Sudden changes or unusual deposits can delay — or cancel — your loan.

19. Keep Your Credit Stable

Continue paying bills on time, keep credit card balances low, and avoid opening new accounts. Lenders check your credit again before closing.

20. Communicate Quickly With Your Realtor & Lender

Speed matters. Fast responses to requests, documents, and questions help prevent delays and strengthen your offer.

SECTION 7 — Appraisal, Competition, & Preparing for Closing

21. Understand the Appraisal Process

The appraisal confirms the home’s value for the lender. If it comes in low, your Realtor will help you navigate renegotiation, appraisal gap coverage, or cancellation depending on your contract.

22. Prepare for Competitive Situations

Winning offers often combine strong terms, fast timelines, clean contingencies, and flexibility — not just price. Most people focus on price alone, there are many items that can be the reason someone is able to purchase a house and someone else was not able to.

23. Plan Your Move Early

Schedule movers, set up utilities, arrange mail forwarding, and plan ahead so the transition is smooth.

SECTION 8 — Closing Day

24. Review the Final Closing Disclosure

Your lender will provide a Closing Disclosure at least three days before closing. Review it carefully to confirm all fees, rates, and credits are correct.

25. Celebrate — You Did It!

Once documents are signed and recorded, you receive your keys and become the official homeowner. Enjoy your new home!

We are ready to help you achieve your goals, the American dream and get you into the house you are dreaming of!! Reach out to one of us to make it happen.

Zach Miller 218-288-1054

Bailey Burnham 218-766-7670

Melissa Hoover 218-556-4604

Doug Hoover 218-766-5588

Categories

Recent Posts