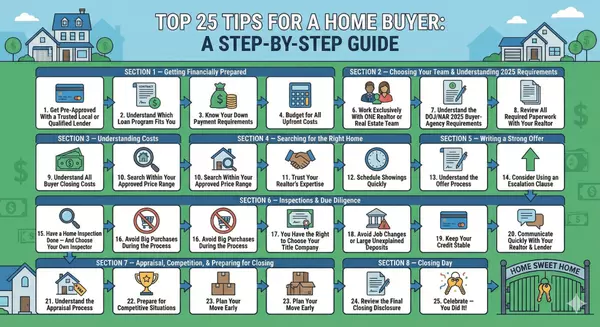

What You Need Before You Decide to Start Shopping for Your First Home

Starting the journey toward homeownership is exciting, but the key to a smooth experience is preparation. Before you schedule showings or scroll through listings for hours, it helps to have a few important pieces in place. When you take time to prepare, you shop with confidence, make stronger offers, and avoid stress later on.

Get Your Finances in Order

Before you do anything else, take a look at your budget. Figure out what you are comfortable spending each month, not just what a lender says you can afford. This includes your future mortgage payment, utilities, insurance, and everyday expenses. A clear picture of your finances helps you stay focused on homes that truly fit your lifestyle.

Check and Strengthen Your Credit

Your credit score has a big impact on the interest rate you receive. A higher score can save you thousands over the life of your loan. Look at your credit report, fix any mistakes, and pay down small balances if you can. Even a small improvement can make a big difference.

Get Preapproved by a Lender

A preapproval letter is one of the strongest tools you can have in today’s market. It shows sellers that you are qualified and ready. It also tells you exactly what you can spend, which prevents disappointment and saves time. Many first time buyers also qualify for grants or down payment programs, so a lender can help you understand all your options.

Know Your Must Haves and Your Deal Breakers

Before you look at homes, make a simple list. Think about bedrooms, bathrooms, yard size, neighborhood, commute, and style. Decide what you absolutely need and what you can live without. When emotions run high during showings, this list keeps you centered and helps you make smart choices.

Choose a Real Estate Agent Early

Many people wait to find an agent until they are ready to see homes, but starting early is better. A good agent explains the process, connects you with trusted lenders, and helps you prepare for what comes next. They also keep an eye on new listings so you do not miss opportunities in your price range.

Understand the Costs Beyond the Down Payment

Closing costs, inspections, earnest money, insurance, and moving expenses can surprise first time buyers. Your agent and lender can walk you through typical costs so you can plan ahead. When you know what to expect, nothing catches you off guard.

Learn the Market in Your Area

Spend a little time looking at recent sales in your preferred area. This helps you understand what homes truly cost and how quickly they sell. The more you know about your local market, the better prepared you are when it is time to write an offer.

Final Thoughts

Taking a little time to prepare before you start house hunting sets you up for success. Once your budget is clear, your preapproval is in hand, and you know what you want in a home, the whole process feels more exciting and a lot less stressful. You get to enjoy the fun part like touring homes, imagining your future space, and dreaming about that first night in your new place. If you are feeling ready or just want someone to walk you through the next steps, I am always happy to help.

Categories

Recent Posts